All Categories

Featured

Table of Contents

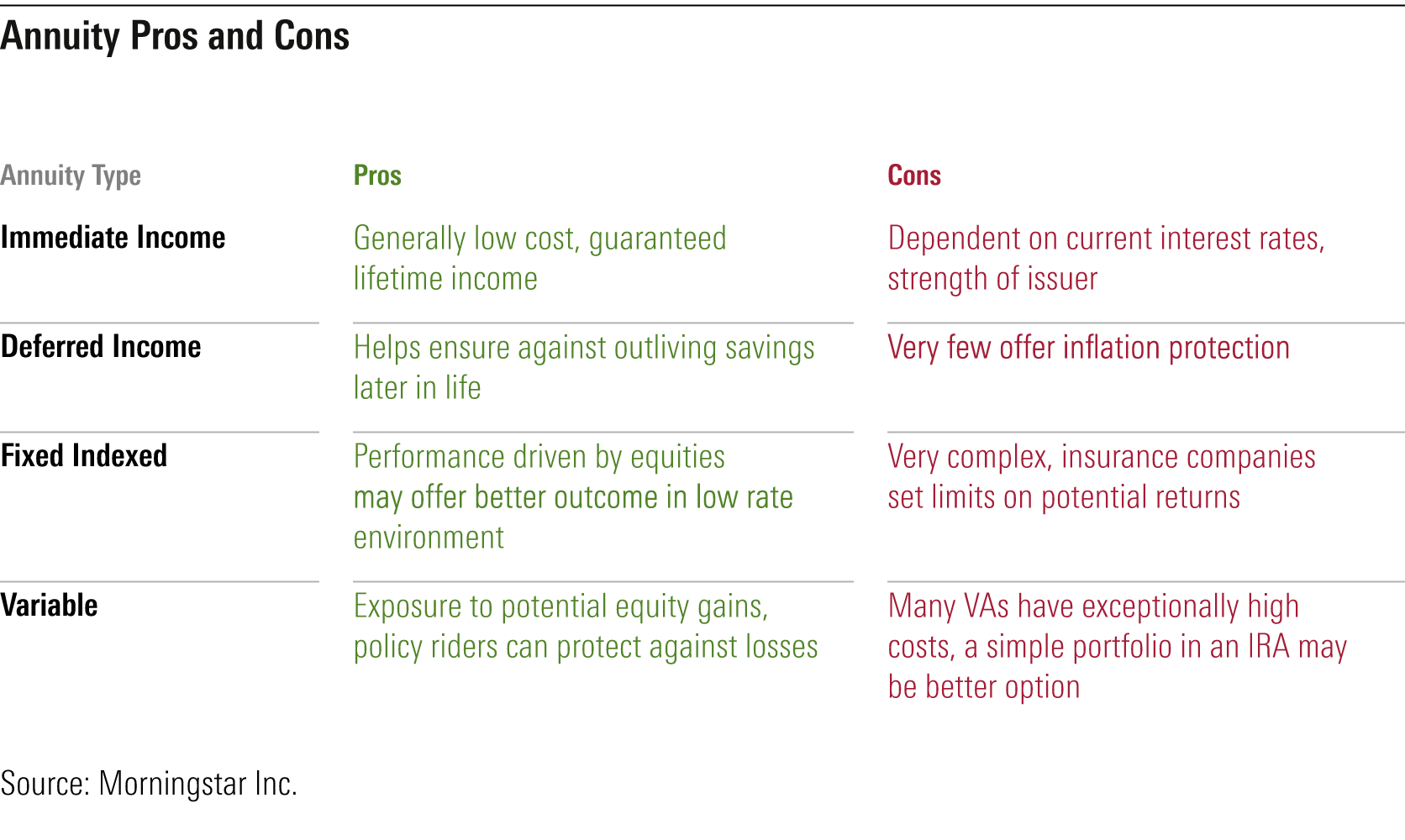

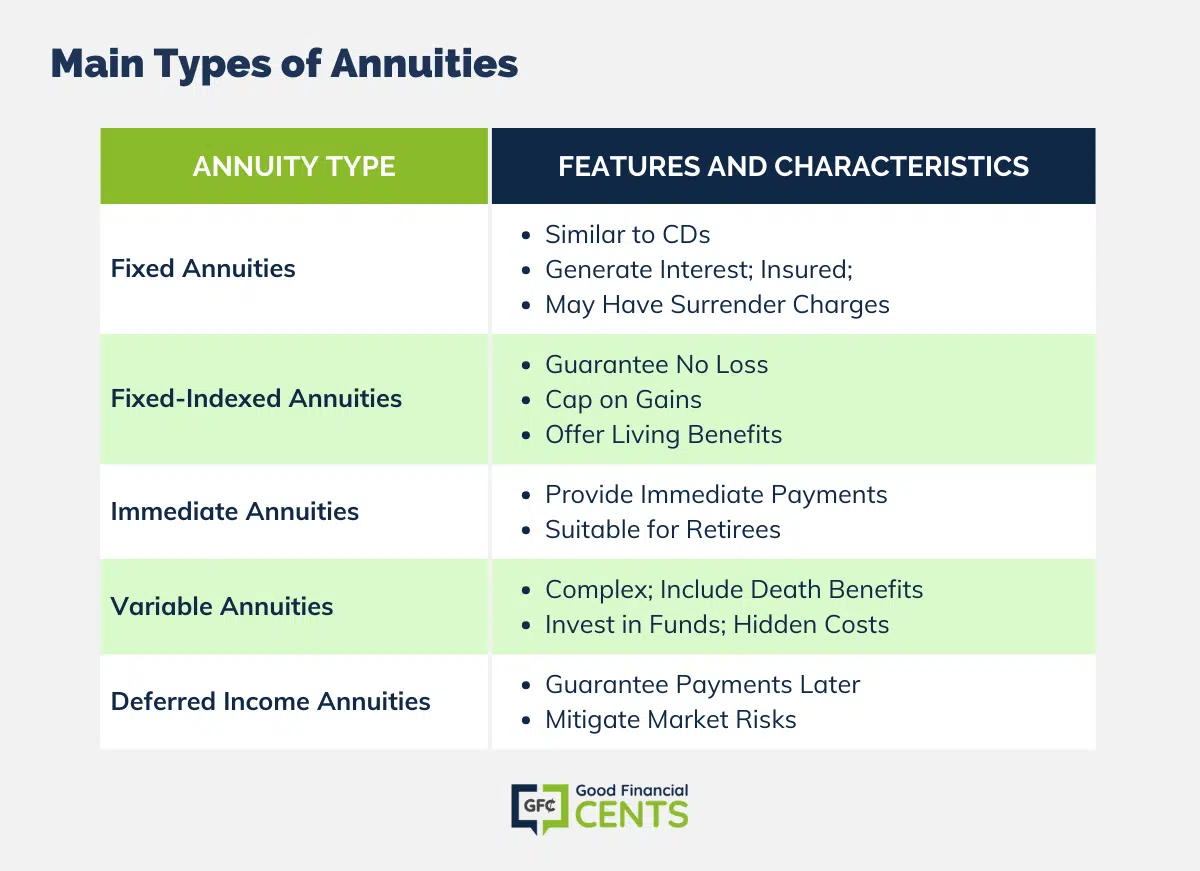

There are three kinds of annuities: taken care of, variable and indexed. With a repaired annuity, the insurance business assures both the rate of return (the rate of interest rate) and the payout to the investor.

With a deferred set annuity, the insurance provider consents to pay you no less than a specified interest rate during the time that your account is expanding. With an instant set annuityor when you "annuitize" your delayed annuityyou receive a predetermined fixed amount of money, normally on a monthly basis (comparable to a pension).

While a variable annuity has the advantage of tax-deferred growth, its yearly expenditures are most likely to be much greater than the expenses of a regular shared fund. And, unlike a taken care of annuity, variable annuities don't provide any type of assurance that you'll earn a return on your investment. Instead, there's a risk that you could really lose cash.

Exploring the Basics of Retirement Options Everything You Need to Know About Fixed Index Annuity Vs Variable Annuities What Is Fixed Indexed Annuity Vs Market-variable Annuity? Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Is Worth Considering Fixed Index Annuity Vs Variable Annuity: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Retirement Income Fixed Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Deferred Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Vs Variable Annuity Pros And Cons A Closer Look at Fixed Vs Variable Annuity Pros And Cons

Due to the complexity of variable annuities, they're a leading source of investor grievances to FINRA. Prior to getting a variable annuity, thoroughly reviewed the annuity's prospectus, and ask the individual selling the annuity to explain every one of the product's functions, cyclists, costs and constraints. You should likewise understand how your broker is being made up, including whether they're getting a payment and, if so, exactly how much.

Indexed annuities are complicated financial instruments that have qualities of both fixed and variable annuities. Indexed annuities usually provide a minimum surefire rate of interest rate integrated with a passion price linked to a market index. Numerous indexed annuities are tied to wide, well-known indexes like the S&P 500 Index. Some use various other indexes, including those that represent various other sections of the market.

Recognizing the functions of an indexed annuity can be complicated. There are numerous indexing methods firms utilize to compute gains and, due to the range and complexity of the techniques used to credit interest, it's hard to contrast one indexed annuity to another. Indexed annuities are usually categorized as one of the adhering to 2 kinds: EIAs provide a guaranteed minimum rate of interest (commonly at the very least 87.5 percent of the costs paid at 1 to 3 percent interest), as well as an extra rate of interest tied to the efficiency of one or more market index.

With variable annuities, you can invest in a selection of securities including supply and bond funds. Stock market performance figures out the annuity's worth and the return you will get from the cash you invest.

Comfortable with changes in the stock market and want your investments to equal inflation over an extended period of time. Youthful and wish to prepare monetarily for retirement by gaining the gains in the supply or bond market over the long term.

As you're developing your retired life financial savings, there are numerous methods to stretch your money. can be particularly helpful savings devices since they ensure a revenue amount for either a set amount of time or for the rest of your life. Dealt with and variable annuities are two alternatives that offer tax-deferred development on your contributionsthough they do it in different methods.

Breaking Down Your Investment Choices A Comprehensive Guide to What Is Variable Annuity Vs Fixed Annuity Breaking Down the Basics of Pros And Cons Of Fixed Annuity And Variable Annuity Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: Simplified Key Differences Between Annuities Fixed Vs Variable Understanding the Key Features of Deferred Annuity Vs Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Deferred Annuity Vs Variable Annuity FAQs About Indexed Annuity Vs Fixed Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Variable Vs Fixed Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

variable annuity or both as you plot out your retirement revenue plan. An offers a surefire rate of interest. It's taken into consideration a traditional item, supplying a modest profits that are not connected to market performance. Your contract worth will increase due to the amassing of ensured passion earnings, meaning it will not lose worth if the marketplace experiences losses.

Your variable annuity's financial investment efficiency will certainly impact the size of your nest egg. When you begin taking annuity payments, they will depend on the annuity value at that time.

Market losses likely will lead to smaller sized payments. Any kind of passion or other gains in either kind of contract are protected from current-year taxation; your tax obligation obligation will certainly come when withdrawals start. Allow's look at the core attributes of these annuities so you can choose exactly how one or both might fit with your total retired life approach.

A set annuity's worth will certainly not decrease due to market lossesit's regular and steady. On the other hand, variable annuity values will certainly change with the efficiency of the subaccounts you elect as the marketplaces increase and drop. Earnings on your dealt with annuity will very rely on its gotten rate when purchased.

On the other hand, payout on a fixed annuity bought when rate of interest prices are low are most likely to pay revenues at a lower rate. If the passion rate is guaranteed for the size of the agreement, earnings will remain continuous despite the markets or price task. A fixed price does not suggest that dealt with annuities are risk-free.

While you can't arrive on a fixed price with a variable annuity, you can choose to buy conventional or aggressive funds customized to your risk degree. A lot more conservative financial investment alternatives, such as temporary bond funds, can help in reducing volatility in your account. Because fixed annuities offer a set rate, reliant upon present rate of interest, they don't use that exact same versatility.

Understanding Financial Strategies A Comprehensive Guide to What Is Variable Annuity Vs Fixed Annuity Breaking Down the Basics of Fixed Indexed Annuity Vs Market-variable Annuity Advantages and Disadvantages of Different Retirement Plans Why Variable Vs Fixed Annuities Can Impact Your Future How to Compare Different Investment Plans: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Variable Annuities Vs Fixed Annuities A Beginner’s Guide to Fixed Vs Variable Annuity A Closer Look at Retirement Income Fixed Vs Variable Annuity

You possibly can gain more long term by taking added threat with a variable annuity, but you could also shed money. While repaired annuity agreements stay clear of market danger, their compromise is much less growth potential.

Investing your variable annuity in equity funds will give more potential for gains. The charges connected with variable annuities might be greater than for other annuities. Financial investment choices, survivor benefit, and optional advantage assurances that could expand your assets, also include price. It's vital to assess attributes and associated costs to make certain that you're not investing greater than you need to.

The insurance coverage firm may enforce abandonment costs, and the Internal revenue service might impose an early withdrawal tax obligation charge. They begin at a specific percentage and then decrease over time.

Annuity earnings go through a 10% early withdrawal tax charge if taken before you reach age 59 unless an exemption applies. This is imposed by the IRS and puts on all annuities. Both repaired and variable annuities give alternatives for annuitizing your balance and transforming it right into an assured stream of lifetime earnings.

Analyzing Fixed Vs Variable Annuities A Closer Look at How Retirement Planning Works Defining Retirement Income Fixed Vs Variable Annuity Advantages and Disadvantages of Different Retirement Plans Why Deferred Annuity Vs Variable Annuity Is a Smart Choice Immediate Fixed Annuity Vs Variable Annuity: Simplified Key Differences Between Fixed Income Annuity Vs Variable Annuity Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Vs Variable Annuities? Tips for Choosing the Best Investment Strategy FAQs About Variable Annuity Vs Fixed Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Indexed Annuity Vs Market-variable Annuity A Beginner’s Guide to Annuities Variable Vs Fixed A Closer Look at How to Build a Retirement Plan

You may decide to utilize both fixed and variable annuities. If you're selecting one over the other, the differences issue: A may be a much better choice than a variable annuity if you have an extra conservative risk resistance and you seek predictable passion and principal protection. A might be a far better option if you have a greater danger resistance and desire the capacity for long-lasting market-based growth.

Annuities are agreements sold by insurance provider that promise the purchaser a future payout in regular installations, usually monthly and often for life. There are various types of annuities that are developed to serve various purposes. Returns can be fixed or variable, and payouts can be instant or postponed. A set annuity warranties payment of a set amount for the regard to the contract.

A variable annuity varies based on the returns on the mutual funds it is spent in. Its value can go up or down. An instant annuity begins paying out as quickly as the buyer makes a lump-sum repayment to the insurance provider. A deferred annuity starts settlements on a future day set by the buyer.

Annuities' returns can be either dealt with or variable. With a repaired annuity, the insurance coverage company assures the buyer a details settlement at some future day.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices A Closer Look at Pros And Cons Of Fixed Annuity And Variable Annuity Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Different Retire

Decoding How Investment Plans Work Key Insights on Your Financial Future What Is Variable Vs Fixed Annuity? Features of Smart Investment Choices Why Choosing the Right Financial Strategy Matters for R

Understanding Financial Strategies Everything You Need to Know About What Is Variable Annuity Vs Fixed Annuity What Is Fixed Income Annuity Vs Variable Growth Annuity? Benefits of Choosing the Right F

More

Latest Posts